CA Anaheim Automation Application for Credit 2019-2026 free printable template

Show details

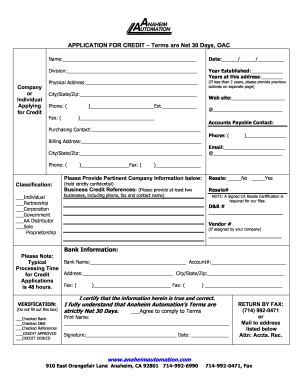

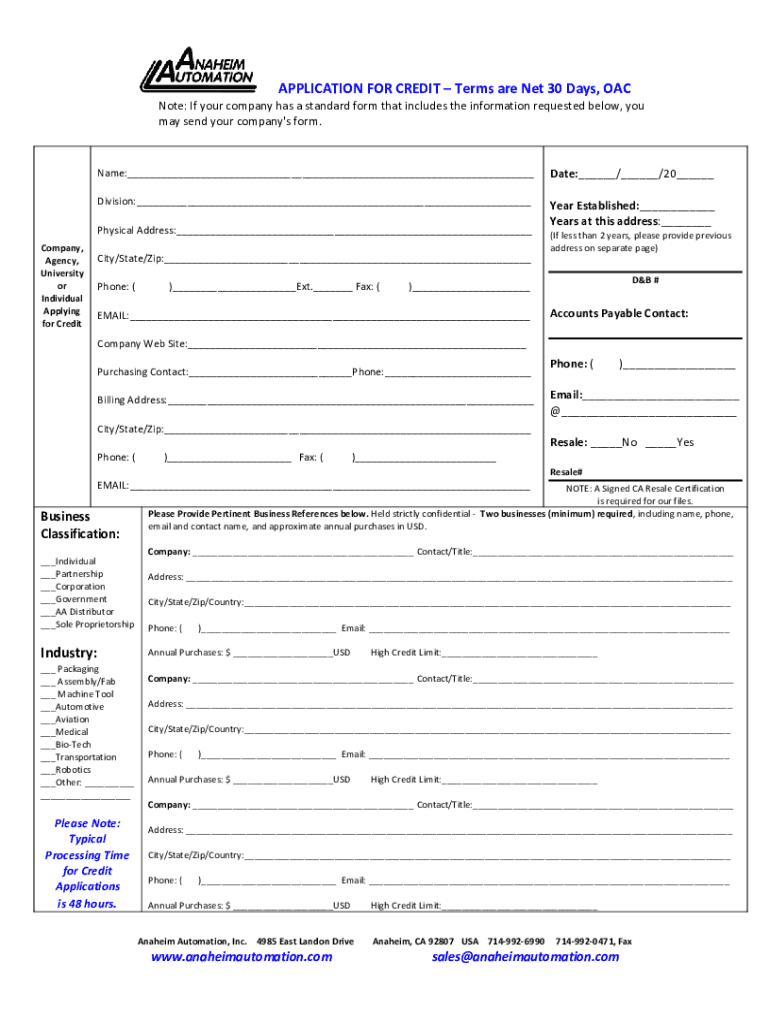

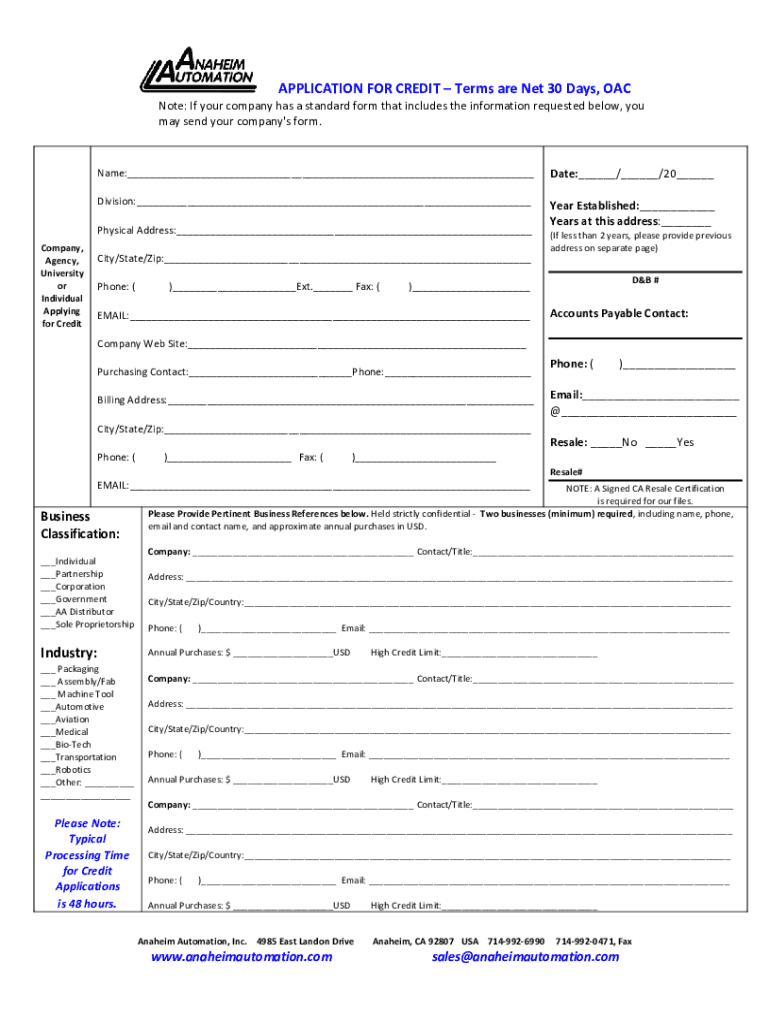

This document serves as an application for credit for individuals or businesses seeking to establish a credit account with Anaheim Automation, Inc. It collects essential information regarding the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign net 30 agreement template form

Edit your net 30 contract template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net 30 payment terms template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing net 30 invoice template online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit net 30 credit application template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Anaheim Automation Application for Credit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out net 30 form

How to fill out CA Anaheim Automation Application for Credit

01

Obtain the CA Anaheim Automation Application for Credit form from their official website or office.

02

Complete the contact information section with your name, company name, address, phone number, and email.

03

Provide a brief description of your business activities and how you intend to use the credit.

04

Fill out the financial information section, including your business's annual revenue, bank references, and trade references.

05

Review the terms and conditions of credit application and ensure that you understand them.

06

Sign and date the application form where indicated.

07

Submit the completed application via email or postal service as directed in the application instructions.

Who needs CA Anaheim Automation Application for Credit?

01

Businesses and companies looking to purchase automation products or services from CA Anaheim Automation on credit.

02

Existing customers who wish to increase their credit limit for future purchases.

03

New customers wanting to establish a credit relationship with CA Anaheim Automation for purchasing automation equipment.

Fill

30 day payment terms letter template

: Try Risk Free

People Also Ask about net 30 contract

Does Net 10 include weekends?

Keep in mind, however, that if you don't meet the payment terms and pay within that 10-day window, you'll have to pay the entirety of that invoice with no discount. Remember that this includes weekends and holidays, not just business days.

How many days is net 30?

What does net 30 mean? When you offer someone net 30 terms, you're offering them the chance to pay you up to 30 calendar days after you bill them for a good or service. Net 30 is a form of trade credit.

What does 1% 10 net 30 mean?

What Is 1%/10 Net 30? The 1%/10 net 30 calculation is a way of providing cash discounts on purchases. It means that if the bill is paid within 10 days, there is a 1% discount. Otherwise, the total amount is due within 30 days.

Does net 30 include weekends?

Net 30 payment term is used for businesses selling to other businesses, and the 30 days includes weekends and holidays.

What is an example of net 30 payment terms?

Net 30 end of the month (EOM) means that the payment is due 30 days after the end of the month in which you sent the invoice. For example, if you and your client agree to net 30 EOM and you invoice them on May 11th, that payment will be due on June 30th—in other words, 30 days after May 31st.

How do you write net 30 terms in a contract?

How to offer net 30 terms to your customers 30 business days or 30 calendar days; 30 days from the product's purchase date vs. invoice date; Net 30 end of the month (EOM) - payment is due 30 days after the end of the month in which the invoice was issued.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my net 30 application directly from Gmail?

net 30 invoice sample and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send net 30 application template to be eSigned by others?

To distribute your cracker site pdffiller com site blog pdffiller com, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out net 30 payment terms example on an Android device?

Use the pdfFiller mobile app and complete your list of net 30 companies pdf and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA Anaheim Automation Application for Credit?

The CA Anaheim Automation Application for Credit is a form used by businesses in California to apply for credits related to automation and technology improvements.

Who is required to file CA Anaheim Automation Application for Credit?

Businesses in California that have made eligible automation investments and wish to claim tax credits must file the CA Anaheim Automation Application for Credit.

How to fill out CA Anaheim Automation Application for Credit?

To fill out the CA Anaheim Automation Application for Credit, businesses need to provide their identification information, details about the automation investments, and any required supporting documentation.

What is the purpose of CA Anaheim Automation Application for Credit?

The purpose of the CA Anaheim Automation Application for Credit is to allow businesses to claim tax credits for investments made in automation technologies, thereby incentivizing modernization and efficiency.

What information must be reported on CA Anaheim Automation Application for Credit?

The application must report the business's name and address, California tax identification number, description of automation technologies acquired, costs incurred, and any other relevant financial information supporting the credit claim.

Fill out your CA Anaheim Automation Application for Credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Letter Of 30 Days Credit Terms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.